According to a recent report by CryptoQuant, XRP’s derivatives market on Binance is entering a transitional phase marked by rising volatility, but without the kind of leverage extremes that typically precede sharp market dislocations.

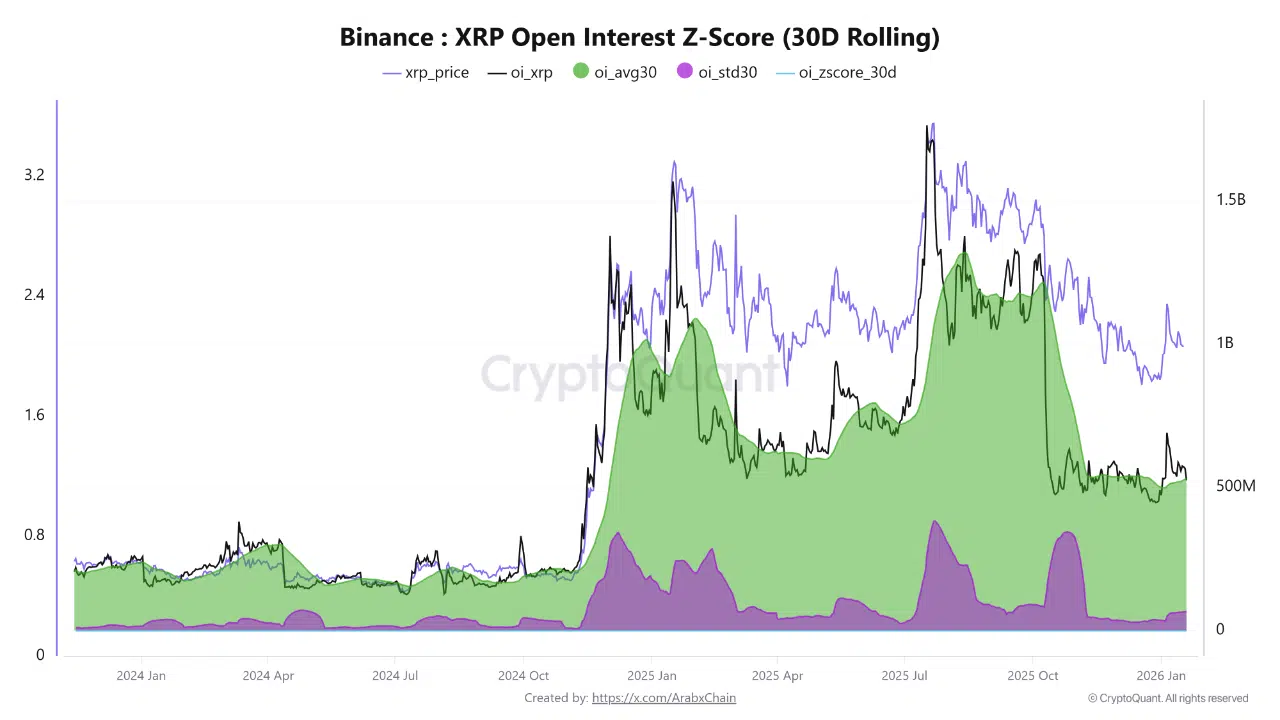

Current data shows XRP open interest climbing to approximately $566.48 million, moving above its 30-day average of $528.84 million. This divergence indicates that fresh positions are being added to the market, though not at an aggressive or euphoric pace. Instead, positioning appears deliberate, suggesting traders are gradually increasing exposure rather than chasing price.

The more notable development lies in volatility dynamics. The 30-day rolling standard deviation of open interest (oi_std30) has risen to around $65.7 million, the highest level observed since November.

Historically, rising standard deviation reflects widening dispersion in positioning and is often associated with markets preparing for larger directional moves. Importantly, this increase is occurring without a corresponding surge in leverage excess.

That restraint is visible in the 30-day Open Interest Z-Score, which currently sits near 0.57. This level remains well below thresholds typically associated with overheating or forced liquidations. In practical terms, it suggests that while risk is increasing, the derivatives market has not yet entered a crowded or unstable state.

Taken together, the data points to a cautious accumulation environment. Volatility is expanding, participation is rising, but leverage remains controlled. These conditions often precede decisive price action once a directional catalyst emerges. Until then, XRP’s derivatives structure reflects a market building pressure rather than releasing it—making changes in open interest volatility a key metric to watch in the days ahead.