The Ripple token, XRP, is currently experiencing a price drop, even though activity from large holders, often referred to as “whales,” on Binance has notably slowed down.

Data sourced from the XRP Ledger indicates a significant decrease in the transfer of large XRP amounts to exchanges, reaching levels not observed since 2021. An analyst from CryptoQuant, Arab Chain, reported that the Whale Transfer Flow, a metric tracking these substantial transfers, initially dipped to 48 million XRP before seeing a slight increase to 56.1 million.

This metric holds considerable importance because a high volume of token transfers to exchanges by whales typically signals their intention to sell. Such actions increase selling pressure and can consequently drive down the price. Conversely, a low level of transfer activity suggests that whales are opting to hold onto their tokens, which can limit the supply available on exchanges and potentially foster conditions for future price appreciation.

Historically, periods of low whale activity, such as observed in 2021, have been followed by significant price rallies, attributed to a tighter supply and increased demand. Despite the current reduction in whale selling pressure, XRP’s price has fallen to a three-day low. It is presently trading at $2.07, reflecting a 1.45% decrease over the last 24 hours and a 2.65% decline over the past week. However, over the past month, XRP has seen an approximate 7% increase.

January flipped a switch

Large holders eased off Binance, with whale inflows dropping to their lowest level in seven months

Less rush to exchanges usually means one thing: big players aren’t in a hurry to sell pic.twitter.com/uiifwS3E7W

— Santolita (@SantoXBT) January 16, 2026

The current short-term price decline is largely influenced by the broader cryptocurrency market, which has seen a 1.09% decrease in the last 24 hours, bringing the total market capitalization to $3.23 trillion. Major cryptocurrencies, including Bitcoin, Ethereum, and Solana, are also experiencing downward trends, indicating an overall bearish sentiment across the market.

Although whale activity is low and selling pressure is diminished, XRP continues to be affected by a downtrend. This suggests that prevailing market conditions can exert a more significant influence on prices than the dynamics of individual tokens. Analysts point out that historical periods characterized by low whale activity have often preceded price rallies, as a restricted supply on exchanges tends to drive up demand.

While XRP is currently in a declining phase, the reduction in whale transfers could potentially support a price rebound once the broader market stabilizes and the supply available on exchanges remains limited. This confluence of factors suggests the possibility of future growth, notwithstanding the present short-term losses.

XRP Price Bulls Defend $2.00 Support

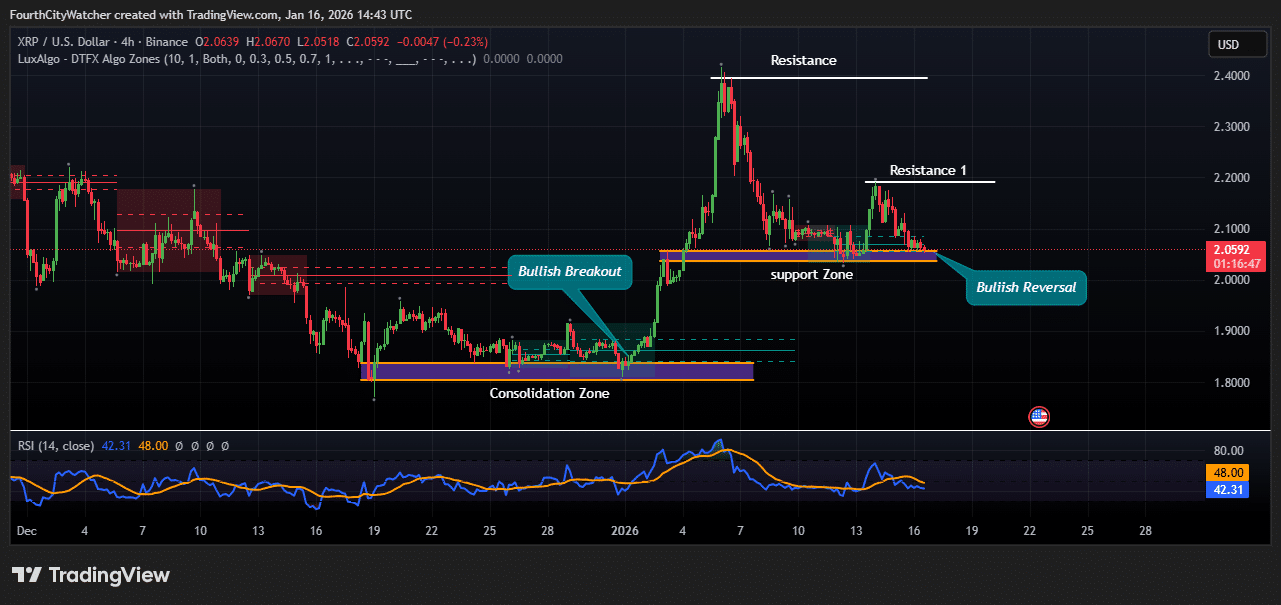

XRP is trading near the $2.05 mark on the 4-hour timeframe, following a pullback from its recent highs. Chart analysis reveals a clear transition from a period of consolidation into a strong bullish breakout, which was subsequently followed by a corrective phase.

Previously, XRP spent several days trading sideways within a consolidation zone situated around the $1.80–$1.90 range. Buyers demonstrated strong support for this area. Once the price successfully broke above this consolidation range, momentum surged significantly, confirming a bullish breakout. This upward movement propelled XRP towards the $2.40 resistance level, where sellers entered the market aggressively.

Following its peak at $2.40, XRP entered a corrective decline. The price pulled back in a controlled manner, establishing a support zone between $2.00 and $2.05. This level is consistent with the previous breakout structure, making it a critical area for buyers. The market is currently retesting this zone, which suggests that the correction might be losing its momentum.

A lower high has formed near $2.20, which is now identified as Resistance 1. This level represents the initial upside barrier. A decisive break above $2.20 could potentially lead to a move towards the major resistance level located around $2.40. Conversely, a failure to reclaim $2.20 might result in the price remaining range-bound between $2.00 and $2.20.

The chart also indicates the formation of a bullish reversal pattern. The price is currently holding above key structural support, and the selling pressure appears to be less intense compared to the previous downward movement. As long as XRP maintains its position above the $2.00 support zone, the bulls are expected to retain control of the broader market structure.

The Relative Strength Index (RSI) for a 14-day period is currently hovering around 42. This level is below the neutral 50 mark but does not indicate oversold conditions. It suggests that bearish momentum is diminishing rather than accelerating. A return of the RSI above 50 would serve as confirmation of renewed bullish strength.