The XRP price experienced a 7% decline in the last 24 hours, trading at $2.21 as of 4 a.m. EST. This price movement occurred alongside a 28% drop in trading volume, which fell to $7.47 billion.

The decrease in the Ripple token's price comes as Bitwise and Grayscale have announced management fees for their planned XRP and Dogecoin Exchange Traded Funds (ETFs). Bitwise has set a management fee of 0.34% for its XRP ETF, while Grayscale plans to charge a 0.35% fee for both its XRP and DOGE ETFs.

Both firms are proceeding with their ETF launch plans despite not yet receiving explicit approval from the Securities and Exchange Commission (SEC), a situation exacerbated by the ongoing government shutdown. New listing rules now permit finalized ETF filings to automatically take effect after 20 days, provided all requirements are met, even without direct SEC approval.

🚨 Breaking Crypto News: Grayscale Investments has filed amended S-1 registration statements with the SEC for spot ETFs tracking XRP and Dogecoin! Each comes with a low 0.35% annual management fee, removing delay provisions for faster effectiveness, and using cash-based… pic.twitter.com/benR2NRxh2

— Invest Alpha Pro (@JrSydrick) November 4, 2025

This strategic move by Grayscale mirrors its earlier launch of a Solana ETF, which debuted successfully despite regulatory silence. Similarly, Bitwise's SOL ETF attracted strong inflows of $56 million on its inaugural day, prompting further expansion. Canary Capital has also entered the market with ETFs linked to Litecoin and Hedera (HBAR).

According to Nate Geraci, president of ETF Store, spot XRP ETFs could potentially launch within the next two weeks. This development would represent a significant milestone, particularly after years of legal disputes between Ripple and the SEC.

Analysts suggest that the successful launch of XRP and DOGE ETFs could attract billions of dollars in investment inflows.

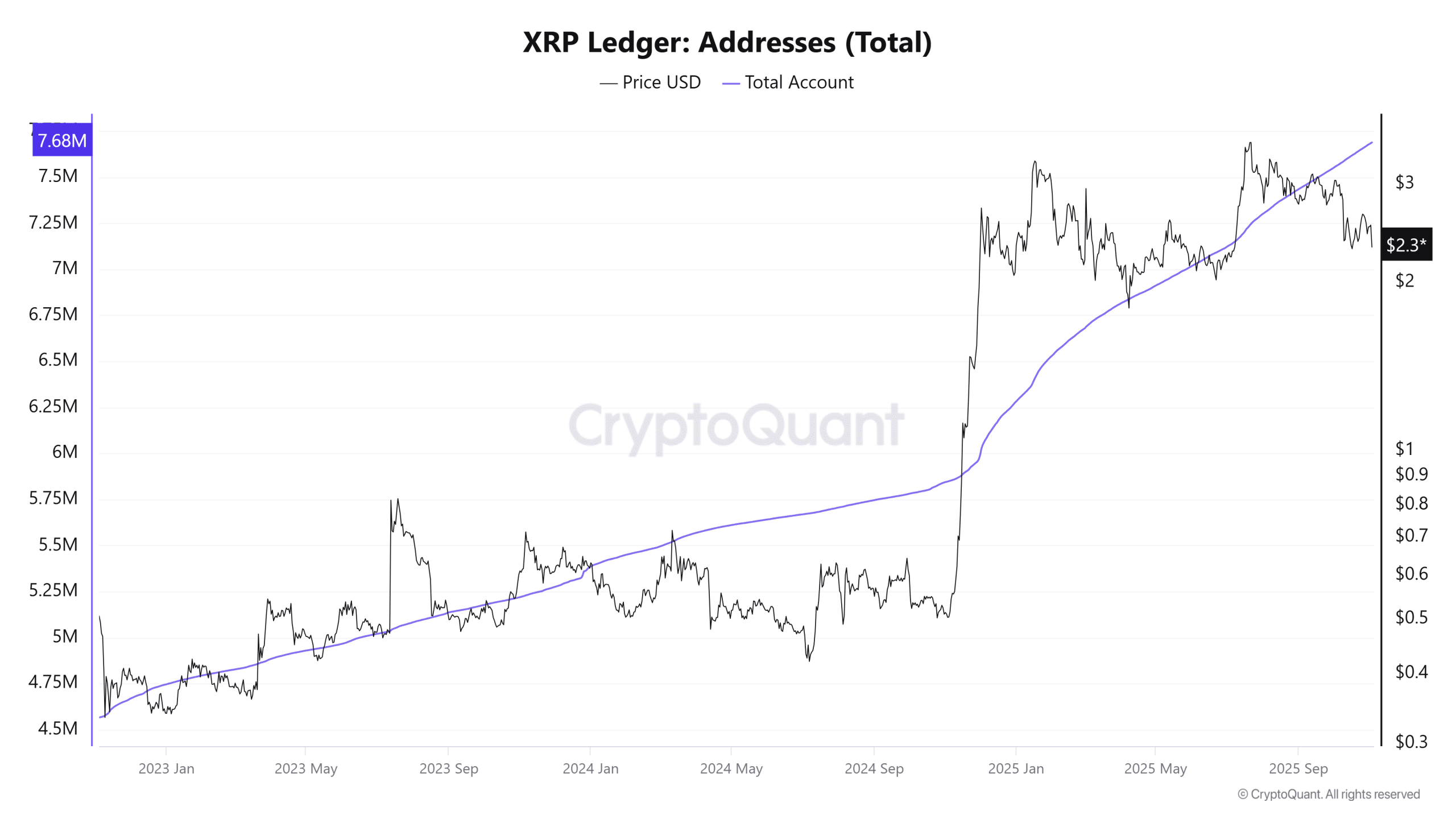

XRP Ledger Addresses Hit Record 7.68 Million

The XRP Ledger has achieved a significant milestone, with the total number of addresses reaching 7.68 million. This data, sourced from CryptoQuant, indicates a steady increase in network activity and user adoption, even as the XRP price currently trades lower at approximately $2.3.

In early 2023, the XRP network had around 4.5 million addresses. Since then, the number of accounts has seen consistent growth, demonstrating strong community engagement. The most substantial surge occurred in late 2024, when XRP's price rose from below $1 to over $3, boosting investor confidence and attracting new users to the platform.

Despite the recent price correction, the continuous growth in wallet creation suggests that an increasing number of users are establishing long-term positions on the XRP Ledger. This trend points to growing trust in Ripple's blockchain ecosystem and its expanding applications in global payments and asset tokenization.

Analysts interpret this growth as a positive long-term indicator. While short-term market fluctuations remain unpredictable, the rising number of unique addresses signifies a healthy and active network.

As Ripple continues to forge partnerships and advocate for broader blockchain adoption, the robust user base of the XRP Ledger could provide crucial support for future price recovery.

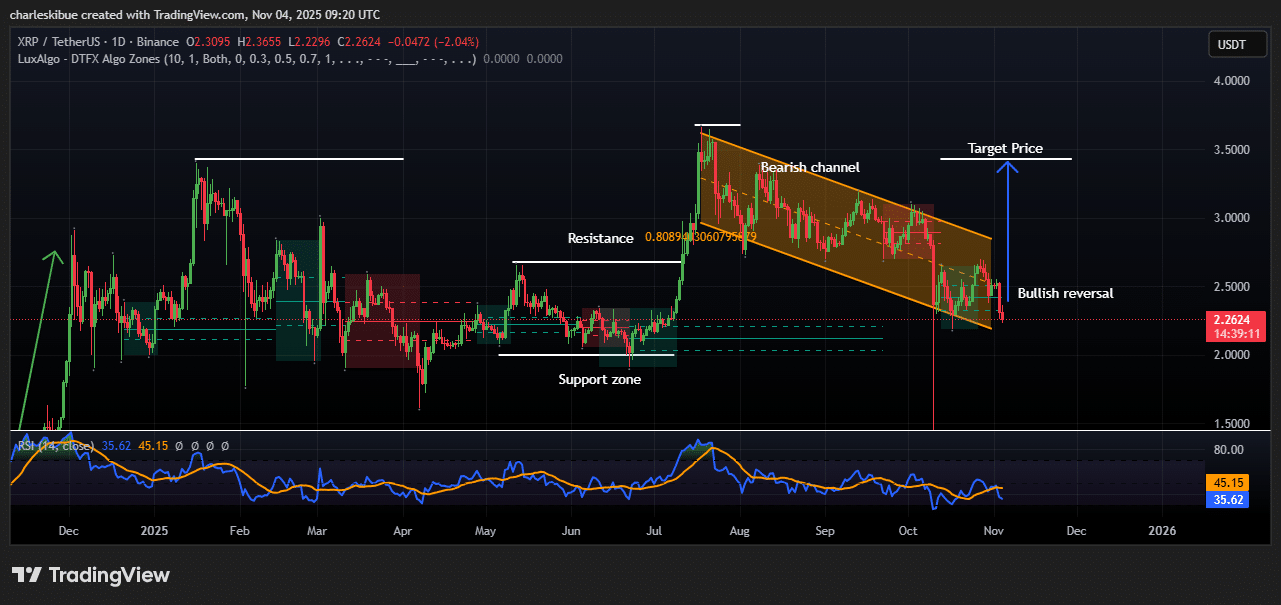

XRP Price Signals A Bullish Reversal

The XRP price is currently exhibiting early indications of a bullish reversal after experiencing several weeks of decline within a clearly defined bearish channel. The token is trading around $2.34, marking a 1.52% increase in the past 24 hours. This suggests that buying momentum may be returning as traders anticipate a trend reversal.

On the daily chart, XRP has been trading within a downward-sloping channel since August. During this period, sellers maintained control, pushing prices lower from approximately $3.50 to recent lows near $2.00.

However, the most recent candle has broken above the lower boundary of this channel, signaling a potential shift in market sentiment. If this breakout is sustained, XRP could target a move towards the upper resistance level, near $3.50, which would indicate a bullish reversal pattern.

The chart also highlights a critical support zone situated between $1.80 and $2.00, which has previously acted as a strong area of demand. This zone has once again proven effective in preventing further declines, providing a stable foundation for bulls to build momentum.

The next significant resistance level is observed around $2.80, followed by the target price of $3.50 indicated on the chart.

XRP Price Could Push Toward $3.5

From a technical standpoint, the Relative Strength Index (RSI) has recovered from oversold levels and is currently hovering around 45. This suggests an improvement in buying pressure, although it remains below the 50 mark, which would be necessary to confirm stronger bullish momentum. A sustained RSI crossing above 50 would likely signal the continuation of a new upward trend.

A confirmed breakout above the channel resistance, coupled with sustained trading above the $2.50 level, could trigger a new rally towards $3.50. Conversely, if the price falls back below the $2.00 support level, the existing bearish trend may reassert itself. Traders are advised to closely monitor these levels for confirmation of the next significant market movement.