Georgia has entered into a significant blockchain agreement with Hedera, aiming to explore the implementation of on-chain land registries and real estate tokenization. This partnership is designed to enhance the transparency of property rights by migrating national records onto Hedera’s distributed ledger technology network.

The potential expansion of tokenization in the real estate sector could positively influence price predictions for cryptocurrencies like Chainlink and XRP, as both projects are structured to facilitate real-world integrations. However, substantial upside potential is being highlighted for early-stage tokens, such as DeepSnitch AI, with investors anticipating significant growth in 2026.

Georgia Explores On-Chain Property Rights with Hedera Partnership

Georgia’s Ministry of Justice has signed a memorandum of understanding with the blockchain platform Hedera. This agreement signifies an intention to explore the feasibility of placing its land registry and real estate data on-chain.

The Georgian government is considering the migration of the National Agency of Public Registry to Hedera’s network. The primary objectives of this move are to increase transparency, improve reliability, and strengthen the protection of property rights. While this agreement is nonbinding, the formation of joint working groups is planned to assess the practical aspects of implementation.

Georgia has a notable history of engaging with blockchain technology. In 2017, the country began utilizing the Bitcoin blockchain to verify property records. More recently, Georgia has collaborated with Ripple Labs on its central bank digital currency project and with Tether to explore Bitcoin infrastructure development.

Top Altcoin Opportunities for 2025

DeepSnitch AI

DeepSnitch AI is emerging as a key "picks and shovels" investment opportunity for the anticipated next wave of AI-driven cryptocurrency growth. The project's presale has surpassed $670,000, with the token currently priced at $0.02629, representing a 70% increase and offering more immediate profitability than many XRP price predictions.

DeepSnitch AI is developing a comprehensive ecosystem intended to serve millions of traders who feel disadvantaged by insider trading and large-scale market manipulation. Its agents, such as SnitchFeed for tracking significant financial movements and SnitchScan for identifying potential scams before they affect retail investors, aim to position the platform as a vital tool within the Web3 space, comparable to a Bloomberg Terminal in traditional finance.

The timing for DeepSnitch AI appears advantageous, coinciding with projections that AI spending will reach $1.5 trillion. The platform is strategically positioned to capitalize on this significant market expansion.

With the presale scheduled to conclude in January and indications of Tier 1 exchange listings shortly thereafter, this presents a rare opportunity for early investors to potentially achieve substantial returns. The current phase is highlighted as a critical moment for entry.

XRP Price Prediction: ETF Inflows Bolster Market Activity

On December 3rd, XRP traded near the $2.18 mark, having reached a high of $2.21. The key resistance level to watch is between $2.23 and $2.27; a sustained break above this zone could potentially lead to further price increases towards $2.50 or even $2.80.

Recent dips have been supported by strong levels between $1.91 and $1.97. The price is currently moving into the Ichimoku cloud, a technical indicator often signaling potential trend shifts in XRP price predictions.

Bullish crossovers are forming on the charts, and the On-Balance Volume (OBV) indicator has stabilized, suggesting a decrease in selling pressure and renewed accumulation. In a span of just two weeks, spot XRP Exchange-Traded Funds (ETFs) have accumulated $844.99 million, adding over 318 million XRP tokens to their holdings.

Market participants are closely observing the $2.27 level. Many XRP price predictions suggest that a decisive break through this resistance could trigger a significant upward price movement, especially if accompanied by strong trading volume.

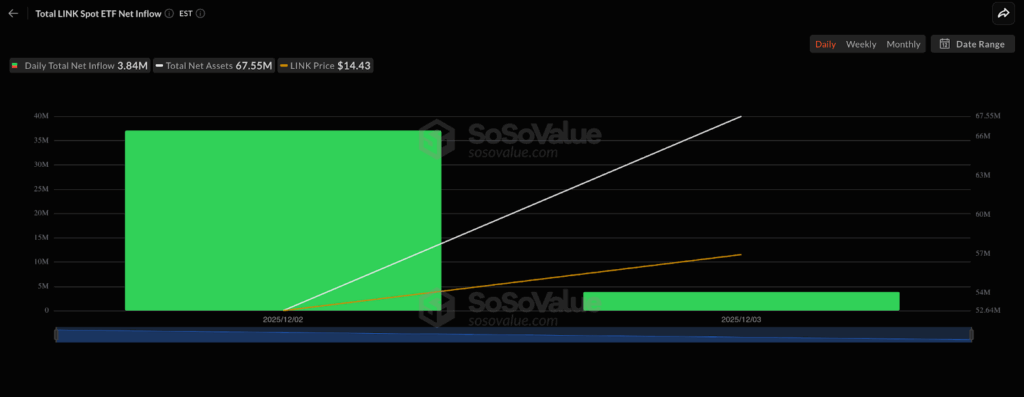

Chainlink Surges on ETF Launch and Inflow Attraction

Chainlink experienced an 18% surge on December 3rd, reaching $14.38. This price movement followed the launch of the first US Chainlink ETF by Grayscale on NYSE Arca. The ETF features no management fees, utilizes Coinbase for custody services, and is already accessible on platforms like Fidelity and Robinhood.

On technical charts, LINK has shown resilience, bouncing off the $12.50 support level. The asset is forming a four-year descending wedge pattern, which is considered a strong bullish setup. If the price breaks through the $18-$20 range, subsequent targets are projected at $26, with potential to reach $47 if ETF demand continues to grow.

Concluding Thoughts on Investment Potential

The cryptocurrency market cycle leading into 2026 is showing increasing momentum. While XRP and Chainlink are experiencing positive developments, the most significant returns are anticipated from early-stage projects. The potential for 100x growth is largely considered to be behind XRP and Chainlink due to their established market capitalizations, which limit the scope for such explosive gains as indicated by many XRP price predictions.

DeepSnitch AI is presented as the primary opportunity for substantial growth. Currently priced at $0.02629, this early-stage protocol is developing tools designed to empower retail traders and provide them with a more equitable trading environment.

With over $670,000 already raised in its presale and discussions of Tier 1 exchange listings preceding its January launch, an investment of $100 at this stage could represent a strategically significant decision for the current cycle.

Frequently Asked Questions

How does the current XRP market outlook compare to DeepSnitch AI’s early-stage potential?

The XRP market outlook is currently strong, influenced by increasing institutional inflows. However, its substantial market capitalization inherently limits its upside potential compared to the significant growth prospects of early-stage projects like DeepSnitch AI heading into 2026.

What is the XRP trading sentiment right now, and why are some investors choosing DSNT instead?

XRP trading sentiment is positive, driven by demand from ETFs. Nevertheless, many traders are opting for DeepSnitch AI due to its potential to deliver much larger returns than what is typically projected for XRP, given its more mature price structure.

Does any XRP future prediction match the upside DeepSnitch AI offers?

Most future prediction models for XRP anticipate steady growth rather than the exponential gains seen in early-stage cryptocurrencies. DeepSnitch AI offers the type of high-upside potential that XRP, due to its established market position, is no longer positioned to deliver.