On December 10, US national banks received official clearance from the US Office of the Comptroller of the Currency to handle crypto transactions as riskless principals. This regulatory update significantly alters how mainstream finance interacts with digital assets.

With this development, the XRP price prediction for 2026 becomes considerably more interesting. When traditional banks begin processing crypto for their customers, Ripple’s payment network emerges as a strong contender for the underlying infrastructure.

However, the potential for substantial gains lies with DeepSnitch AI. This presale project is developing AI tools designed to provide traders with actionable intelligence on whale movements, order flow, and market manipulation.

As banks onboard millions of new users into the crypto space, having sophisticated tools becomes crucial for successful trading. Analysts are highlighting this as a significant opportunity for substantial returns in 2026.

Banks Get the Green Light to Handle Crypto Trading

The Office of the Comptroller of the Currency issued an interpretive letter on December 10, confirming that national banks can facilitate crypto trades without holding digital assets on their balance sheets. They are authorized to connect buyers and sellers, earn fees, and remain compliant with federal banking regulations.

The OCC clarified that assisting customers with crypto trading falls under the purview of normal banking activities as defined by 12 U.S.C. § 24. Banks are required to manage risks, ensure compliance, and adhere to their established procedures. This action effectively resolves regulatory uncertainty.

For those monitoring XRP price drivers, this ruling is highly significant. Ripple has built its business model around enhancing the speed and cost-effectiveness of cross-border payments for financial institutions. With US banks now legally permitted to process crypto, XRP is positioned as a natural infrastructure layer for these activities. The XRP market forecast is heavily influenced by the pace at which banks implement these services, but the official authorization is now in place.

This development could impact the XRP price prediction and presents opportunities in other top cryptocurrencies for December.

DeepSnitch AI (DSNT): AI for Exposing Market Manipulation

The market complexity is set to increase exponentially as US banks begin processing crypto transactions for millions of mainstream customers.

DeepSnitch AI aims to simplify this complex landscape. While others may be overwhelmed by data, DeepSnitch AI intends to provide clear insights into smart money positioning. The project features five AI tools, with three currently available during its presale phase, transforming vast amounts of blockchain data into actionable trading intelligence.

Users can track whale wallets, identify significant orders before they impact markets, detect potential scams, monitor market sentiment, and observe liquidity in real-time.

The Stage 3 presale is active, with tokens priced at $0.02735. This represents an 80% increase from the initial presale price of $0.0151, and the project has already raised over $735,000. Both Coinsult and SolidProof have audited the smart contract and provided clean reports, addressing security concerns.

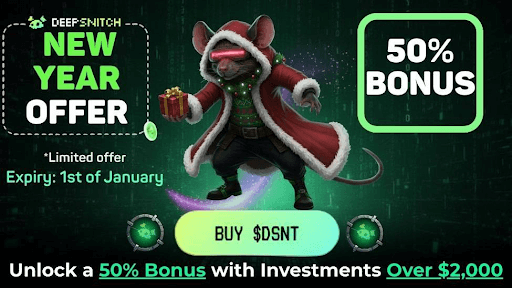

The project offers an aggressive bonus structure. Using the code DSNTVIP50 provides a 50% bonus on token purchases of at least $2,000, while DSNTVIP100 doubles the tokens for purchases exceeding $5,000. Both bonus codes are valid until January 1.

The project anticipates exchange listings on Tier 1 and Tier 2 platforms, generating significant community interest on Telegram and X. Early investors are anticipating potential returns of 50x to 100x, a level of upside that established cryptocurrencies may struggle to match, especially when compared to current XRP price predictions.

XRP Price Prediction for 2025-2026

In 2024, many expressed skepticism about XRP reaching $2, deeming investments in it as imprudent. However, by July 2025, XRP surged from $0.50 to $3.65, achieving a 7x gain and dispelling much of the doubt.

Looking ahead to 2026, the XRP price prediction appears positive. Ripple's payment network is engineered to facilitate faster and more cost-effective cross-border transactions for banks. The recent OCC approval for US banks to handle crypto transactions aligns perfectly with XRP's growth trajectory.

Conservative XRP technical analysis suggests that a move above $2.50 could initiate a rally towards $3 to $3.50 in the first half of 2026. While a 100x increase from its current valuation is unlikely, a doubling or tripling of its price is plausible if banking adoption accelerates.

Rain Coin (RAIN) Update for 2026

RAIN is currently trading around $0.007 as of December 10, following a rise to its all-time high of approximately $0.008 on November 24. This surge was triggered by the announcement that Enlivex Therapeutics, a Nasdaq-listed biotechnology company, is investing $212 million in Rain, bringing the token significant attention.

Additionally, RAIN has surpassed key resistance levels and broken out of a tight trading range, a scenario that often attracts trader interest. The community sentiment is predominantly bullish, with 91% expressing optimism and only 9% pessimism regarding RAIN's future performance.

If current momentum persists and buying interest increases, the price could reach between $0.008 and $0.010. A strong breakout above its all-time high might even propel it towards $0.020.

Conclusion

The OCC ruling represents a significant shift in the market. US banks are now legally empowered to process crypto transactions, removing a major obstacle to widespread adoption. The XRP price prediction is strengthened by the alignment of Ripple's infrastructure with the needs of banks. Key XRP price drivers now include tangible banking integration, moving beyond speculation about future partnerships.

For those seeking potentially life-changing returns, DeepSnitch AI presents an opportunity with its AI tools addressing real market challenges and a presale price under three cents.

Visit the official presale website to secure your position. Join the Telegram and X communities to stay informed about upcoming exchange listing announcements.

Frequently Asked Questions

What are the main XRP price drivers right now?

XRP is experiencing upward momentum due to increased bank adoption of Ripple's services, clearer regulatory guidance in the US, and growing demand for efficient cross-border payment solutions.

What does the XRP technical analysis say?

Currently, XRP is trading around the $2.00 mark, encountering resistance near $2.15. A successful breach of this level could lead to a climb towards $2.60 to $4.00.

What is the XRP market forecast for 2026?

With continued bank adoption of Ripple and improvements in regulatory frameworks, XRP's market forecast for 2026 suggests a potential rise to $5.00 or higher.