The XRP price experienced a downturn, falling 3.9% over the past 24 hours to trade at $2.49 as of 3:46 a.m. EST. This movement occurred amidst a 8% decrease in trading volume, which fell to $5 billion.

This price action coincides with Canary Capital's filing of an updated S-1 for its spot XRP ETF. Notably, the filing removed the "delaying amendment," a provision that previously allowed the SEC to control the timing of the registration process.

This strategic move by Canary Capital potentially sets the stage for an ETF launch on November 13, contingent upon Nasdaq's approval of the 8-A filing.

🚨SCOOP: @CanaryFunds has filed an updated S-1 for its $XRP spot ETF, removing the “delaying amendment” that stops a registration from going auto-effective and gives the @SECGov control over timing.

This sets Canary’s $XRP ETF up for a launch date of November 13, assuming the… pic.twitter.com/MKvEN23t5P

— Eleanor Terrett (@EleanorTerrett) October 30, 2025

Following this update, the ETF now meets the criteria to become automatically effective under section 8(a) of the 1933 Securities Act.

The development also aligns with SEC Chair Paul Atkins' expressed support for companies utilizing the auto-effective method. This approach has previously been employed by Bitwise and Canary in the launches of their SOL, HBAR, and LTC ETFs.

Atkins commended the use of the 20-day statutory waiting period during regulatory shutdowns, emphasizing its efficacy in streamlining public offerings.

With the revised submission, Canary's XRP ETF can proceed without requiring explicit SEC sign-off. It appears poised for advancement once the statutory 20-day period concludes, unless the SEC raises additional comments or concerns.

XRP Price Movements Signal Potential Bearish Continuation

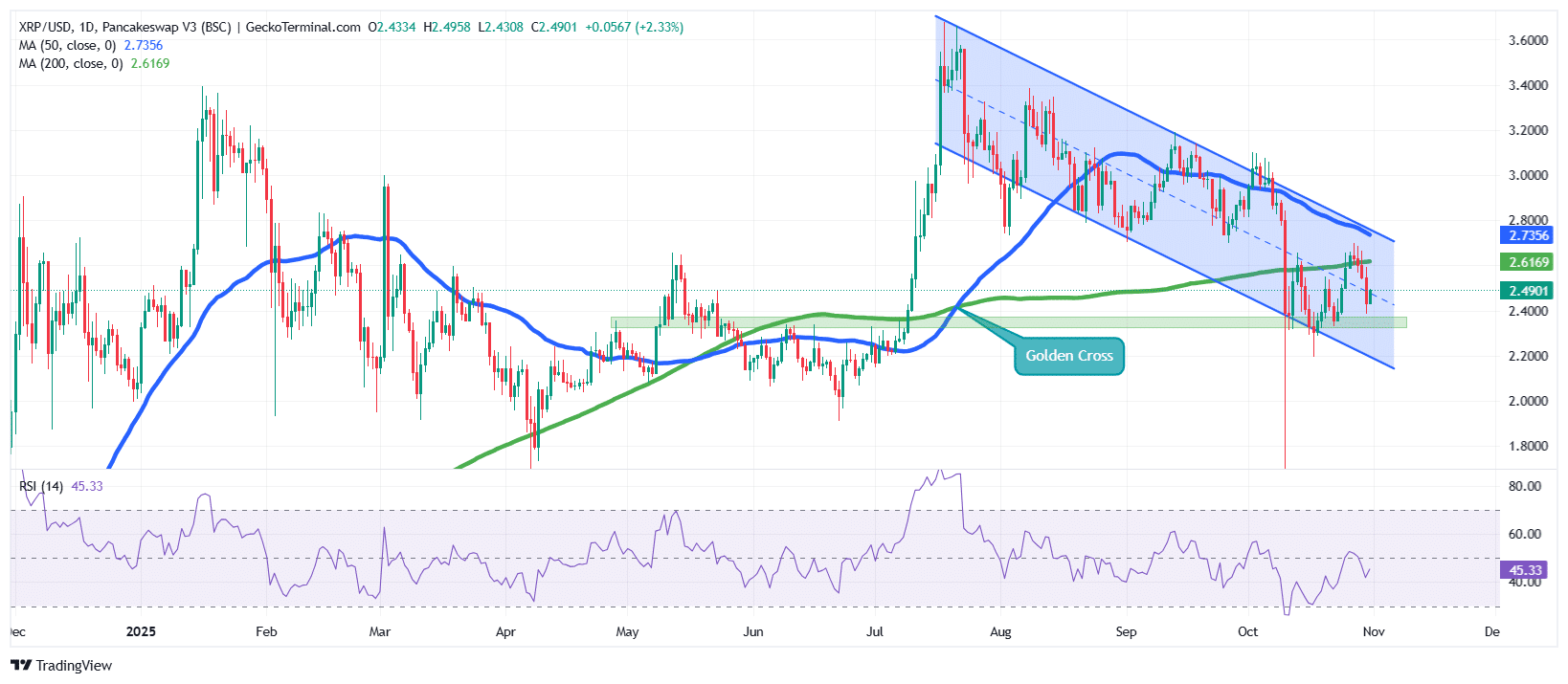

After experiencing a significant rally in July that propelled the XRP price towards the $3.30 zone, market momentum shifted as bears regained control. This led to a retracement that subsequently formed a falling channel pattern.

Throughout this correctional phase, bullish investors have made efforts to defend the support area between $2.40 and $2.45. However, recent market structure analysis indicates that sellers continue to hold dominance.

The ongoing correction has pushed the Ripple token price below its 50-day Simple Moving Average (SMA), which is currently situated around $2.73. This breach confirms that short-term momentum remains negative.

The 200-day SMA, presently around $2.62, is serving as a critical near-term pivot level. A definitive break below this indicator could potentially lead to further downward price movement.

Despite an earlier Golden Cross – a bullish technical indicator where the 50-day SMA crosses above the 200-day SMA – the recent pullback has effectively neutralized this signal. This suggests that XRP may need to retest deeper support levels before any substantial recovery attempt can materialize.

Furthermore, the Relative Strength Index (RSI) is currently positioned near 45.3. This reading indicates reduced buying pressure and a prevailing bearish sentiment in the market.

Ripple Token Targets Support Near $2.35

Considering the current technical indicators and market structure, the XRP price appears to be on a trajectory to test its horizontal support zone around $2.35. This price level has demonstrated resilience, having held firm multiple times in recent months.

A decisive closing price below this established support level could trigger a further decline for the Ripple token, potentially driving it towards the $2.20 mark. This lower target aligns with the descending channel's lower boundary.

Conversely, if bullish investors succeed in defending the $2.40 zone and manage to push the price of the Ripple token above the 50-day SMA at $2.73, XRP could initiate a breakout attempt. Such a move might see the price target the upper boundary of the descending channel, in the vicinity of $2.80–$2.85.

A confirmed closing price above this resistance range would serve as the initial indicator of a potential bullish reversal in the XRP market.

Related News

- •Strategy Surges 5.7% As Q3 Earnings Beat Expectations

- •Mastercard In Talks To Acquire Zero Hash For Up To $2 Billion

- •Otherside x Amazon NFT ‘Boximus’ Goes Live & Sold Out In Hrs