The XRP price experienced a significant surge of 8.6% in the last 24 hours, trading at $2.49 as of 4:15 a.m. This upward movement was accompanied by an 82% increase in trading volume, reaching $4.74 billion.

This notable jump in the Ripple token's price follows the US Senate's advancement of a bill aimed at ending the government shutdown. Investors responded positively to this political development, which helped alleviate concerns about prolonged regulatory uncertainty and bolstered overall market sentiment for cryptocurrencies.

🇺🇸 NOW: The US Senate advances a funding bill to end the government shutdown, clearing the 60-vote threshold. pic.twitter.com/m1zJ1CFFJf

— Cointelegraph (@Cointelegraph) November 10, 2025

The bill, identified as H.R. 5371, secured bipartisan support, indicating that a resolution to the extended funding dispute is now within reach.

Prior to this development, some market analysts had cautioned that a prolonged government shutdown could potentially delay crucial regulatory decisions, thereby hindering a broader recovery in the cryptocurrency market.

Many expect “ETF approvals.” Few understand shutdown mechanics. Here is what actually happens if it continues. Save this. 🧵

2/ If the shutdown drags on, some XRP ETF S-1s can become effective by lapse under Section 8(a). That is paperwork progress, not a trading bell.

👇👇👇 https://t.co/xA25VO54u3pic.twitter.com/3u2FRrPQB3

— XRPthread (@XRPthread) November 10, 2025

With the government shutdown now appearing to be nearing its end, the outlook for XRP appears more optimistic.

XRP, which had fallen below the $2.18 mark in the preceding days during a period of significant market sell-off, has demonstrated a strong rebound, successfully reclaiming key support levels and moving back into positive territory.

Just last month, technical support levels were under pressure, raising concerns about the potential for deeper losses if buyers had not intervened.

Volatility also increased, with liquidations rising across Binance and other major exchanges as bearish traders rushed to close their short positions.

XRP On-Chain Metrics Indicate Resilient Holders

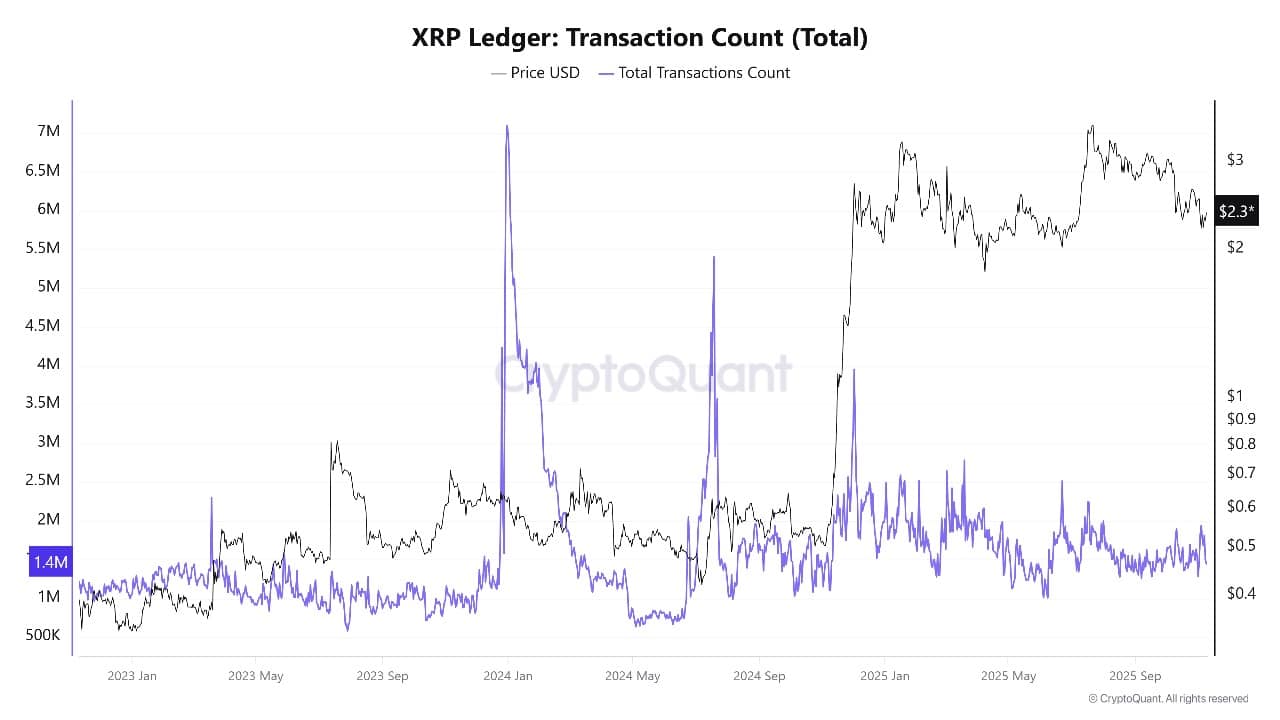

While price action often dominates market discussions, the underlying on-chain data for XRP presents a more nuanced perspective. In recent weeks, a decrease in total network transfer volume and a slowdown in the count of large transactions have been observed, suggesting that some traders had adopted a more cautious stance amidst the prevailing political uncertainty.

Despite these fluctuations in network activity, analysts point to the continued strength of the long-term XRP holder base. Wallet data indicates a minimal number of large outflows or instances of panic selling during the period of government shutdown. Instead, a significant portion of investors utilized the price dips as an opportunity to accumulate more XRP, thereby providing support at critical price levels. Concurrently, exchanges reported a reduction in liquid balances.

Institutional interest in XRP also appears to be holding steady. Several applications for spot XRP Exchange-Traded Funds (ETFs) are currently under review, and the recent breakthrough in the Senate could potentially expedite their assessment by the Securities and Exchange Commission (SEC).

Should the total transaction counts and payment volumes on the XRP Ledger surpass the $1 billion daily threshold, market sentiment is expected to become even more favorable for XRP holders.

XRP Price Technical Analysis: Key Levels to Watch

From a technical perspective, XRP has successfully rebounded from a crucial support zone situated between $2.00 and $2.20. The token is currently trading above its 50-week simple moving average, a significant indicator closely monitored by traders. A strong weekly closing price above $2.54 would serve as confirmation of a bullish breakout, potentially paving the way for a rapid ascent to higher price targets.

Immediate resistance levels are identified at $2.75 and $3.41, areas where previous rallies encountered selling pressure. A sustained break above these levels could open up further upside potential, with targets at $4.20 and potentially $5.21, based on weekly Fibonacci retracement levels.

The current chart patterns suggest that momentum could accelerate significantly if trading volume continues to increase. This upward trend is further supported by a rising 50-week moving average, which is positioned well above the long-term 200-week average currently near $1.04.

The Relative Strength Index (RSI) is currently positioned just below 48, indicating that there is still ample room for price appreciation before the asset becomes technically overbought.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator is showing signs of flattening but remains in positive territory, suggesting the potential for a renewed bullish phase. Consistent buying interest has been observed whenever XRP has approached the support zone in the $2.00–$2.20 range.

If these prevailing trends persist, the XRP price could see a rapid advance towards the $3.41 and $4.20 levels in the coming weeks.

However, traders should remain vigilant for potential short-term selling pressure if the price fails to maintain its position above $2.50.

Dips to the $2.20–$2.30 range might present buying opportunities for patient investors; however, a decisive breach below the $2.00 mark would warrant increased caution.