Key Developments and Market Impact

Canary Capital is set to launch the first U.S. spot XRP ETF, XRPC, following Nasdaq's approval. Trading is scheduled to commence on Thursday, after the ETF cleared necessary regulatory hurdles at 5:30 p.m. on Wednesday.

The anticipation surrounding Canary's XRP ETF has already led to a significant surge in XRP prices, marking a pivotal moment for institutional adoption and establishing a new benchmark within the dynamic cryptocurrency ETF market.

Canary's XRP ETF Launches Amidst High Expectations

Canary Capital has finalized preparations for the launch of the first U.S. spot XRP ETF, named XRPC, with its approval for listing on Nasdaq. This ETF is designed to enhance institutional access to XRP by providing a regulated trading vehicle. Steven McClurg, CEO of Canary Capital, has expressed optimism that this ETF could surpass the initial success observed with Canary's Solana ETF. The mere anticipation of this launch has already contributed to a nearly 10% increase in XRP's market price. McClurg stated, "The XRP ETF could even double the initial success of Solana’s debut ETF."

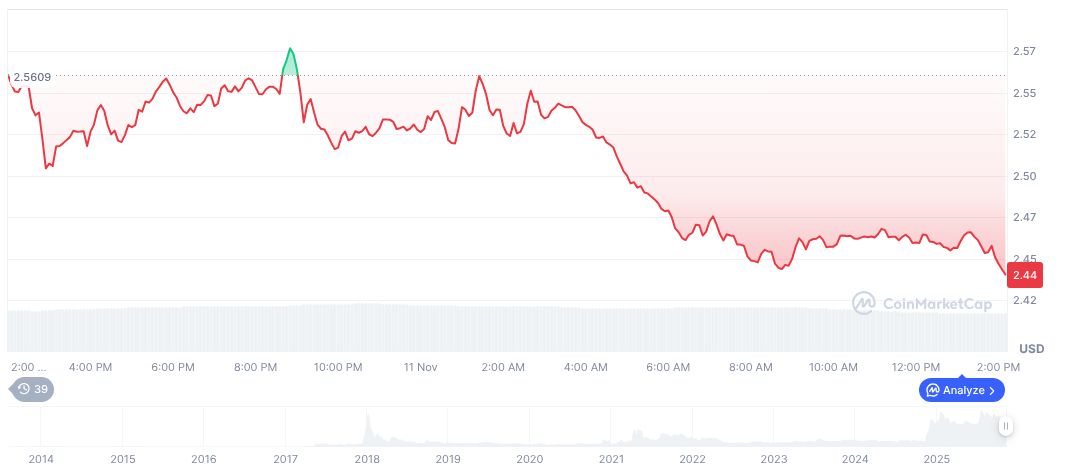

According to available market data, XRP is currently trading at $2.42, boasting a market capitalization of $145.76 billion and holding a 4.18% share of the overall market. Its 24-hour trading volume has seen a decrease of 21.38%, totaling $4.82 billion. While XRP's price has experienced a 4.94% decline in the past 24 hours, it has risen by 8.01% over the preceding week.

XRP Price Surge and Potential Market Shifts

Did you know? The United States has not previously offered any spot ETFs specifically focused on XRP. This development represents a groundbreaking advancement in broadening the range of cryptocurrency financial products available to investors.

Research from the Coincu team indicates that the XRP spot ETF has the potential to stimulate broader discussions regarding the regulation of cryptocurrency ETFs within the U.S. This could foster increased financial innovation and attract greater institutional investment into the digital asset sector.

Nate Geraci, Founder of ETF Institute, commented on the situation, stating, "Form 8-A approval and the end of US gov’t shutdown could ‘open the floodgates’ for many spot crypto ETFs."