Fresh on-chain data reveals that nearly 300 million XRP flowed out of Binance in October, a movement signaling growing confidence among XRP holders. Despite a volatile month, market participants appear to be repositioning ahead of what has historically been XRP’s strongest performance period — November.

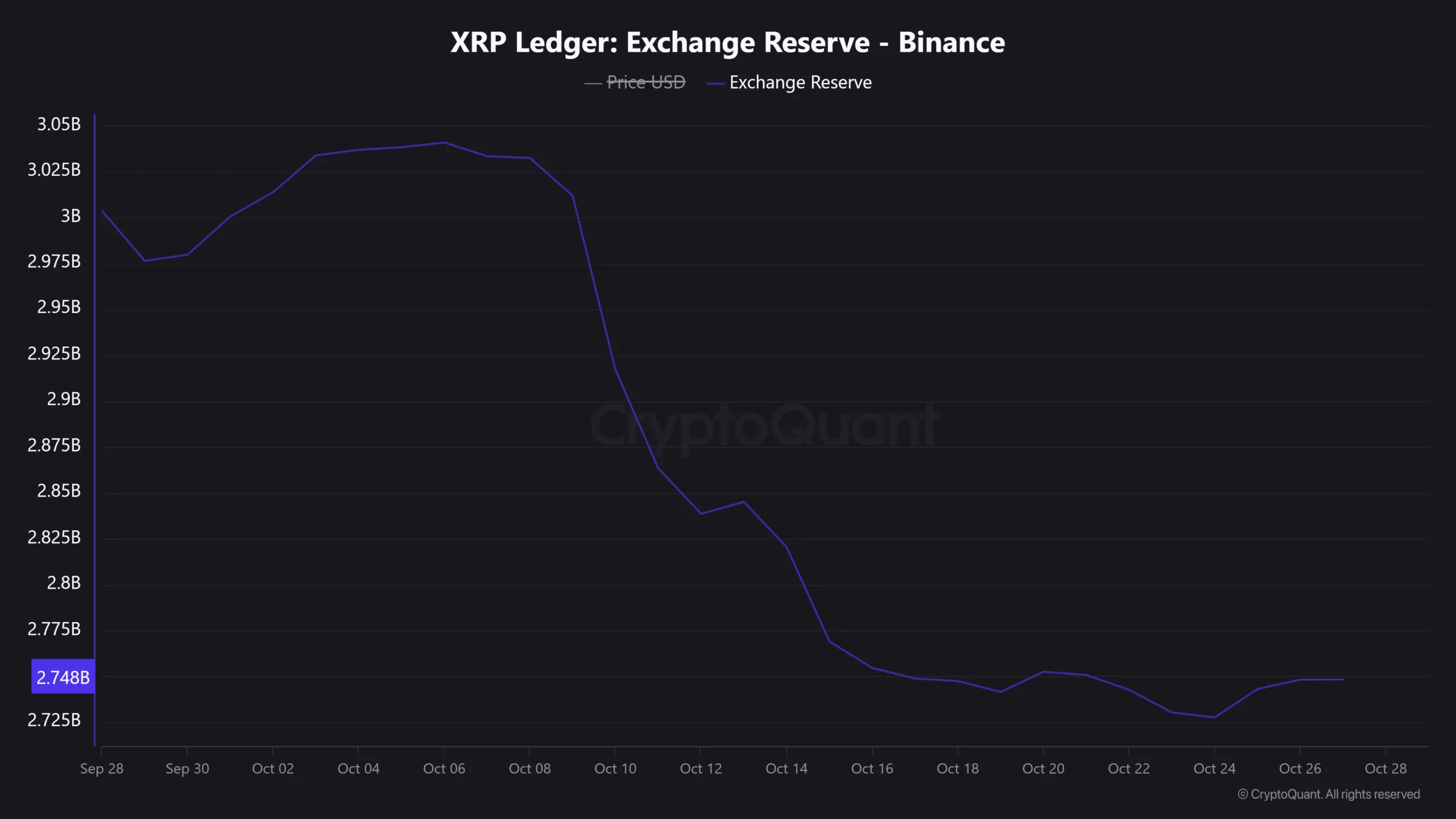

According to the data, Binance’s XRP balance has fallen from over 3 billion tokens to 2.74 billion, marking its lowest level since mid-2024. The downtrend is not isolated to Binance; major platforms, including Bybit, OKX, and HTX, have also recorded similar drawdowns in their XRP reserves.

The CryptoQuant chart underscores a sharp downward slope in exchange-held XRP, showing a rapid depletion in reserves throughout October, a metric often interpreted as reduced selling pressure and rising accumulation behavior.

Investor Behavior Suggests Growing Accumulation Trend

Declining exchange balances typically indicate that investors are transferring tokens off trading platforms into private wallets or institutional custody, signaling long-term conviction.

This shift aligns with XRP’s ongoing narrative of increasing institutional adoption and strategic accumulation ahead of potential catalysts. Interestingly, the outflows have occurred despite XRP’s historically weak October performance.

On-chain data highlights that XRP has closed October in negative territory seven times over the past 12 years, and 2025 appears to be following that pattern. The token has dropped 4.68% month-to-date, though it remains up 1.35% in the past 24 hours, trading at $2.65.

Seasonal Optimism Builds as November Approaches

Historically, November has been XRP’s best-performing month, averaging 88% gains across past cycles. With exchange reserves tightening and on-chain accumulation rising, analysts suggest that investors could be positioning early for a seasonal rebound, potentially setting the stage for a strong close to the year.

The combination of falling exchange supply and bullish seasonal trends may catalyze renewed upward momentum in the XRP market heading into November.