Market Overview

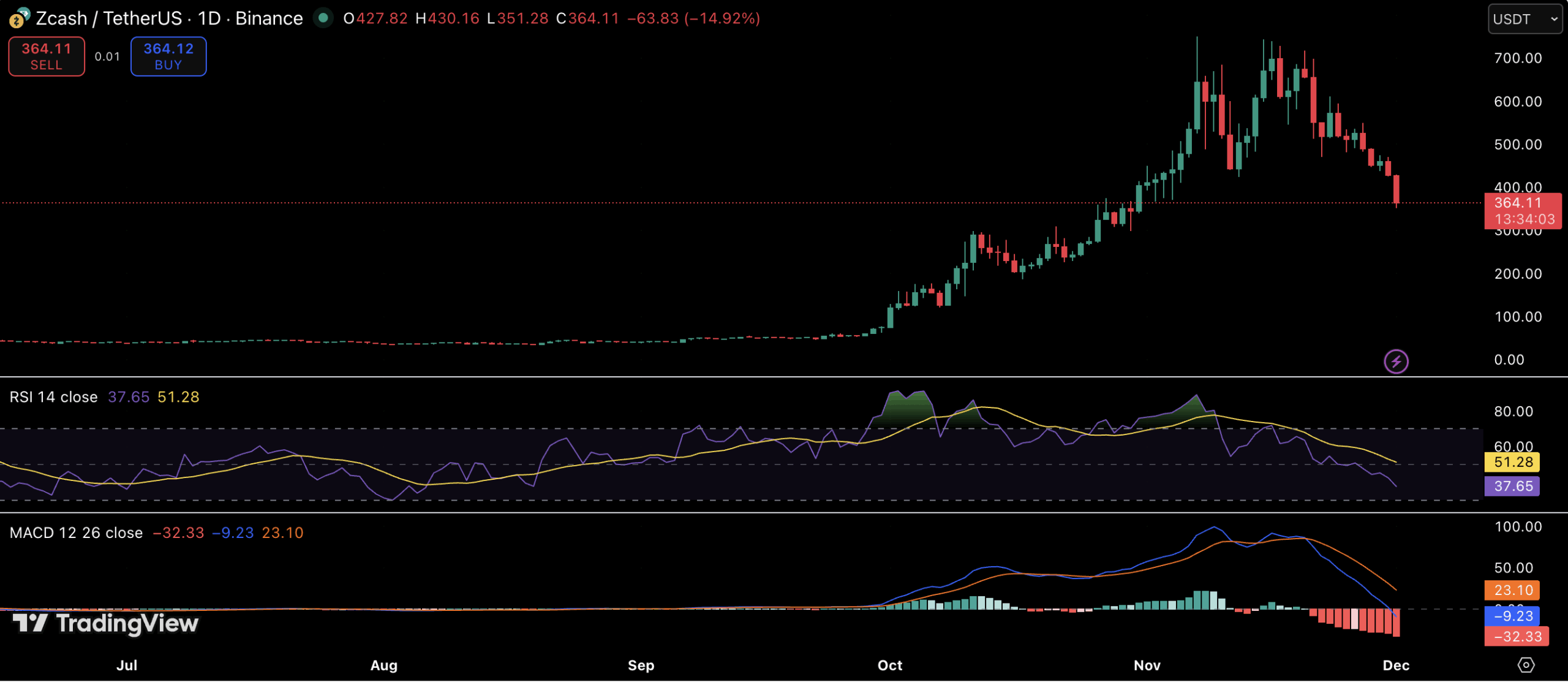

Zcash has experienced a significant downturn, dropping over 50% from its recent peak. The privacy-focused cryptocurrency is now trading near $364, representing one of the steepest corrections among major altcoins this quarter. The sell-off accelerated in the past 24 hours, with ZEC declining another 20% and weekly losses reaching 32%. This sharp decline is accompanied by a surge in trading volumes, indicating widespread panic selling rather than profit-taking.

Technical Indicators Signal Bearish Sentiment

Momentum indicators suggest a severe market reversal for Zcash. The Relative Strength Index (RSI) has fallen to 37, approaching oversold territory. Simultaneously, the Moving Average Convergence Divergence (MACD) has crossed decisively into bearish territory, with widening negative histograms signaling continued downward pressure. Previous technical support levels from early October have already been breached, leaving ZEC vulnerable to further declines if market sentiment does not stabilize.

Governance Turmoil Fuels Price Crash

The sharp price drop is occurring amidst significant internal disputes within the Zcash community regarding a proposed shift to token-based governance. This system would allow token holders to vote on the future direction of the protocol. The debate gained public attention when Ethereum co-founder Vitalik Buterin publicly advised Zcash against adopting such a governance model. Buterin expressed concerns that token voting could lead to the erosion of Zcash's core mission of privacy, as decisions might be influenced by those with the largest token holdings rather than long-term principles. His intervention has amplified existing worries about governance models that prioritize wealth-based voting power, potentially incentivizing short-term gains over fundamental principles. Proponents of token governance highlight its potential for accountability and transparent funding, while opponents fear it could expose privacy-focused projects to market manipulation and corporate influence.

I hope Zcash resists the dark hand of token voting. Token voting is bad in all kinds of ways; I think it's worse than Zcash's status quo. Privacy is exactly the sort of thing that will erode over time if left to the median token holder.

— vitalik.eth (@VitalikButerin) November 30, 2025

Market Confidence Shaken

The timing of the governance dispute has exacerbated market instability. ZEC was experiencing a strong upward trend when the controversy emerged, leading to a rapid shift in investor sentiment. Analysts suggest that the market reaction is not solely based on price movements but also on growing uncertainty about Zcash's future direction. The core question for traders is whether Zcash will remain a mission-driven privacy protocol or transition into a system where development is dictated by large token holders. Until this debate is resolved and a clear path forward is established, investors appear hesitant to re-enter the market.

Future Outlook

Zcash is currently at a critical juncture. Bullish sentiment anticipates that the $350 range will serve as a support level, providing an opportunity for the governance discussions to conclude. Conversely, bearish perspectives suggest that current momentum favors further price declines unless a clear and confidence-inspiring roadmap emerges from the ongoing community process. Ultimately, Zcash's ability to stabilize will depend not only on technical chart patterns but also on its capacity to navigate its governance challenges without compromising the privacy values that have defined its identity.