Recent Zcash (ZEC) price predictions have garnered significant attention due to sharp volatility in the Zcash market, driven by leveraged trading and a clear break in market structure. A substantial wallet holding over 20,000 ZEC on 10x leverage is currently facing severe losses, while technical indicators suggest further downward pressure following a reversal from recent highs.

Background and Context

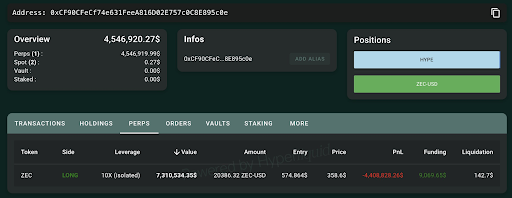

Market data indicates that wallet 0xCF90…895c0e initiated a large long position valued at over $7.3 million with an entry point near $574. As prices declined to approximately $358, the position incurred more than $4.4 million in unrealized losses. To avert liquidation, the trader deposited an additional 1.5 million USDC as collateral, maintaining the leveraged exposure. These actions are influencing current discussions surrounding ZEC price predictions, as analysts assess the impact of controlled forced liquidity management on market sentiment.

Concurrently, chart analysis shared by Crypto Patel highlighted a strong rejection from the $700–$750 region. The token failed to sustain its ascending structure and confirmed a breakdown after testing all-time-high resistance near $753. This reversal triggered a nearly 50% drop, placing traders who entered early short positions in a favorable situation.

Technical Developments and Key Levels

Current models for ZEC price prediction are focusing on the Fibonacci levels now in play. The immediate support level is identified around $259, with deeper target levels located at $186 and $134. Analysts also note the presence of a Fair Value Gap between $90 and $150 that remains unfilled. These levels are crucial for both institutional and retail evaluation of potential market stabilization points.

Despite the overall downward trend, some analysts anticipate a relief bounce in the $400-$450 range. This movement would be consistent with typical corrective action following a significant drawdown and could present short-term trading opportunities. Nevertheless, traders remain attentive to the influence of leveraged positions on liquidity flows and overall risk appetite.

Market Impact and Reactions

The substantial underwater position on Hyperliquid has sparked active discussion among market participants. Some interpret the additional collateral as a defense of long exposure and a postponement of liquidation, while others view the added collateral as an indicator of high stress levels associated with high-risk strategies. These developments significantly impact broader ZEC price prediction models, as analysts consider whether forced exits could accelerate further declines.

The recent update from CryptoPatel reinforced the warning that the market structure remains bearish until the token establishes greater support. His charting methodology, which relies on trendline breaks and historical reaction areas, aligns with the current market behavior.

Future Outlook

Projections for the ZEC price prediction reflect a cautious sentiment. Traders expect continued volatility as leveraged positions unwind and as directional movements are influenced by technical levels. A sustained recovery above key resistance levels would be necessary to alter the current sentiment, while a failure to hold support could prolong the correction.